Product Overview

Payroll crafted for building a better workplace

Spend less time running payroll for your employees so you can focus on growing your business.

Payroll experience redefined to be stress-free

Automatic payroll calculation

Run payroll in a few clicks and automatically generate pay-slips online with a thorough breakdown of taxes, allowances, and deductions.

Embrace diverse salary structures

Create multiple pay slabs for your staff, leads, and managers and associate the right template with each employee.

Pay employees on time every time

Transfer employees' salaries directly to their bank accounts with timely online transfers and readily available bank advice.

Straight-forward statutory compliance

Steer your business clear of compliance penalties. We handle your statutory compliance including (PF,PT,ESI,LWF and IT) and make filing easy with tax reports.

Encourage employee self-service

Enable seamless collaboration between employees and your payroll staff and reduce the burden of employee requests.

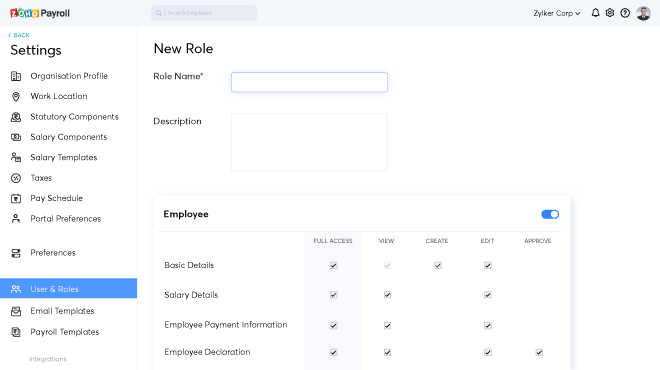

Fine-grain admin privileges

Invite your qualified staff to process payroll but maintain control with user roles and role-based access.

We get payroll done so you can get other things done

Engage people, not process

Scaling up your business fast? Add your new hires to your payroll in a few simple steps, and manage all their information centrally.

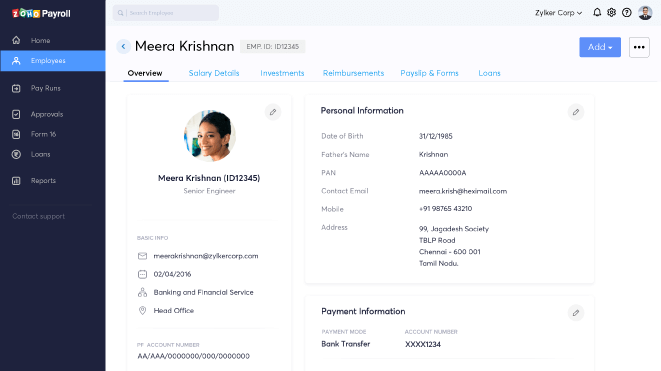

Administer employees' information and records.

Choose how you want to pay your employees.

Manage your employee exit process.

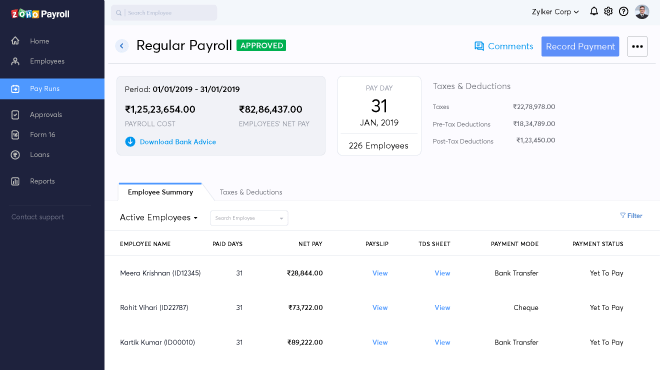

Run payroll in no time

It's time to turn your payroll chaos into order. Automatic payroll calculations help you to process pay runs without breaking a sweat.

Systemize your pay schedule.

Process and approve pay runs in a few steps.

Accommodate one-time or recurring bonus pay runs.

Keep up with tax regulations

We'll help you make accurate tax deductions along with tax-ready reports.

Generate Form 16 for employees to submit income tax returns.

Incorporate statutory components (PF,ESI,PT, Income tax) as per Indian law.

Know your year-to-date payroll cost and tax liabilities.

Powerful integrations for smarter collaboration

We brought HRMS, payroll, and accounting under one roof. Now your teams can work better together, improve productivity, and get more done in less time.

Specifications

Fast Employee Onboarding

Manage your employees and stay on top of your onboarding process

Chart the right course for your payroll operations from the day you hire your first employee.

Everything you need to manage your people, rolled into one

Effortless data migration

Bring all your existing data into Zoho Payroll with minimum effort. Follow our pre-defined template to import salary or previous employment details, and eliminate duplicates and reduce manual work.

Employee hikes, increments, and appraisals

Attract and retain the right talent with the right rewards. Revise the CTC, and pick the date from which the hike in pay will be reflected in the payslips.

Salary history and designation

Follow your employees' career progress by tracking their salary revision history and designation changes. Automatic updates in the self-service portal keeps employees informed too.

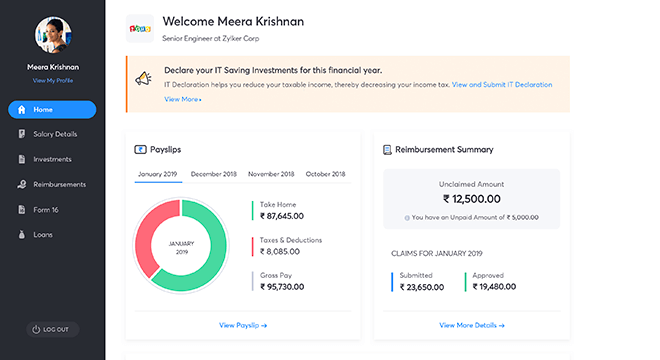

Streamlined employee self-service

Reduce your payroll costs and data entry efforts by delegating routine document tasks to your employees. Employees can do things on their own from the client portal.

Systematic employee exit management

Enter your departing employee's last working day along with the full and final settlement date to process the pay automatically. You can encash unused leaves, send their final payslips, and Form-16 to an email address of their choice.

Automated gratuity settlement

Acknowledge efforts of your long serving staff. With automated gratuity calculation, let your parting employees reap their rewards immediately.

Powerful Administration

Streamline your administration tasks and manage payroll like a pro

Zoho Payroll is everything you need to administer payroll for your organization. You can grant user roles and permissions, delegate responsibilities, oversee approvals, and build your organization your way.

Everything you need to run your payroll

Straightforward setup

Enter your organization details, tax information, employee details, salary components, and pay schedule to get your payroll up and running right away.

Multiple work locations

While you continue to expand your business, we help you to distribute the same perfect payslips across all your branches in different states.

Personalized salary components

Choose different allowances, earnings, reimbursements, and perquisites for different employees. Easily enable or disable individual components, and Zoho Payroll will adjust to your settings and calculate the right pay.

Allowances that reflect your culture

Choose from the list of preset allowances or tailor-make allowance categories to support your employees while they support your business.

Policies that set the tone for your organization

Define your organization's FBP, reimbursement claims, and submission rules for IT declarations and investment proofs. You can collect POIs in multiple phases and set the dates when the resulting tax adjustments will be reflected in your employees' pay.

Empower your staff to collaborate without losing your control

Create unique roles for different teams

Create multiple user roles to help your finance, admin, and auditing teams collaborate effortlessly. Ensure data integrity by granting users role-based access to the specific modules they need.

Delegate payroll responsibilities

Share your workload and get work done faster. Use controlled access to invite your qualified staff to administer payroll.

Implement a payroll approval process

Create payroll approval workflows and ensure pay runs get processed only after they get the go-ahead from you or your payroll administrator.

Send organisational announcements

Send broadcast reminders with the due dates to submit investment proofs, income tax, or flexible benefit plan declarations.

Stay informed with timely notifications

Receive personalized notifications and stay on top of everything that happens within your organization, from adding new employees to your payroll system to setting up their bank information and transferring salaries.

See it all in one place

Get a holistic summary of your entire payroll operation. Check for pending pay runs, outstanding taxes and forms, employees under your payroll, and payroll expenses incurred, all from your dashboard.

Templates make your work easy

Organised salary templates

Support your organisation's salary structure with personalized salary templates for various job roles. Associate a template with each employee and see their salary details get populated automatically.

Professional-looking payslip templates

Choose from our collection of templates to build payslips with a clear breakdown of salary components, allowances, taxes withheld and deductions. .

Personalised portal invites

Invite employees with a personalized message to get their work done, while you get your work done.

Effortless Payroll Processing

Automate and complete your payroll processing in minutes

Stop spending weeks on payroll processing. Zoho Payroll has everything you need to complete your payroll and post-payroll activities faster.

Uncomplicate payroll processing with features that give you more power

Choose an industry-specific pay schedule

Pick a payroll routine that fits your business. Fill your employees' pockets on the last day of every month, or choose your own custom payday.

Complete pay runs in a click

Spend less time completing your payroll. Once you have your paydays and schedule set, a click is all it takes to pay your employees.

Add customized one-time earnings

Plan and manage employee bonuses for holidays or profit-sharing programs and easily apply pre-tax or post-tax deductions.

Apply custom deductions to payslips

Set up one-time or recurring profiles to take care of voluntary and mandatory payroll deductions. Zoho Payroll automatically deducts the right amount and applies the appropriate taxes during each pay run.

Disburse salaries online or offline

Credit employees' salaries directly to their bank accounts online for simple, timely payroll. Offline check payments are easy to record too.

Share secured payslips online

Generate password-protected payslips and make them accessible online in a ready-to-download PDF format.

Receive timely notifications

Zoho Payroll lets you confirm processed payroll, see upcoming tax submission dates, and stay on top of your payroll operations.

Automated loan management

Support your employees' financial needs with loans and track them automatically until they're repaid. Loan installments are periodically deducted from your employees' pay, and real-time notifications keep everyone in the loop.

Adapt pay runs to holidays

Pay date falls on a weekend or a government-declared holiday? Zoho Payroll automatically adapts your pay runs to process the day before the closure.

Temporarily exclude employees from pay runs

Employee leaves can stretch from weeks to months. Easily record the reason for their absence, and continue to process your current pay runs without skipping a beat.

Manage employee exits professionally

Letting an employee go might be hard, but once the decision is made, Zoho Payroll makes the process easy. Run termination payroll to handle your employees' notice pay, leave encashment, and other exit requirements effortlessly.

Secured Employee Self Service Portal

Self-service your employees will love

Provide seamless collaboration between employees and payroll staff with a secure employee portal.

Invite employees to their own workspace online

Keep everything in one place

Don't make employees look around for their payroll information. They can find pay summaries, tax summaries, notifications, loan deductions and much more under one roof.

Process employee reimbursements effortlessly

Employees can reclaim out-of-pocket business expenses and organisation-provisioned reimbursements by attaching the appropriate bills within the portal.

Password-protected employee documents

Secure your employees' payslips and tax computation worksheets with custom passwords to keep their data confidential.

Ace tax season with compliance documents

Help your employees understand their tax liabilities and file their income tax returns with downloadable tax worksheets and Form 16.

Expedite investment proof submissions

Notifications about investment declarations and FBP submissions within the portal ensure that your employees do not miss important submission deadlines.

Status updates on employee loans

Zoho Payroll automatically deducts loan payments and updates the outstanding balance and tenure left for employee loans. Employees can find the latest updates in the portal.

Automatic Compliance and Reporting

Keep payroll compliance easy amidst changing tax laws

Keep your business on a legal footing with Zoho Payroll. Apply appropriate tax deductions, calculate mandatory government contributions, and generate tax compliant payslips.

Empower your staff to collaborate without losing your control

Adapt to varying scenarios

Stay confident of making accurate tax deductions at all times. Changing tax laws, customized pay runs, multiple salary components, and multiple employee pay grades are all easily accounted for in Zoho Payroll.

Build employees' retirement chest

Declare your organization's and employees' PF contributions, and let Zoho Payroll generate payslips with accurate deductions every month, while keeping you compliant.

Deduct social security benefits taxes

Keep the resources ready to help employees wade through unforeseen circumstances with regular contributions to Employee State Insurance.

Collect professional tax accurately

Got employees working in different states? With Zoho Payroll, you can automatically deduct professional tax on the right schedule, whether it's every month, every six months, or every year.

Prepare employees to file IT returns

Generate a digitally signed Form-16 to help employees understand their tax liabilities for the financial year.

Pay Government its dues

Enable TDS deductions for employees who fall into the income tax slabs. See monthly payslip breakdowns and year-to-date tax liabilities automatically.

Account for labour welfare fund

Process LWF automatically for employees. Zoho Payroll calculates and makes the right contributions across all the states.

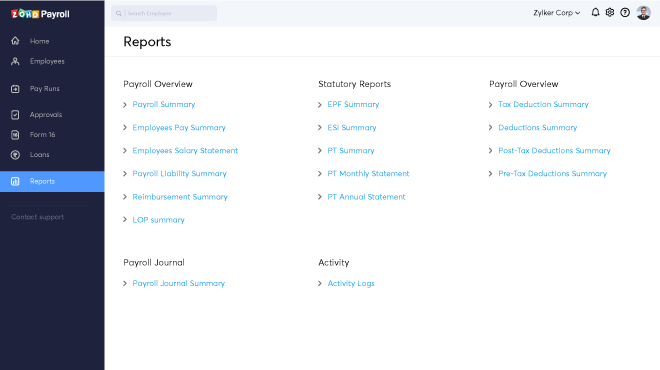

Automated reports do the heavy lifting to keep your organization compliant

Statutory compliance reports

Maintain your clean statutory compliance record and generate reports for the tax authorities whenever called for. Zoho Payroll generates a summary of your EPF, ESI, and Professional Tax instantly.

Payroll compliance reports

Get insights into your payroll operations in seconds. Run specific reports, from employee salaries and reimbursements to overall payroll costs, in a single click.

Income tax return report

Prepare your tax deduction summary report for periodic evaluation. Get a complete report on all your employees, their taxable income, and their income tax withheld.

Payroll journal report

Let your software account for your payroll expenses for you. Zoho Payroll automatically adds payroll journal entries and condenses them into a neat, organised summary.

Audit trail reports

Follow what's happening in your payroll department with detailed audit reports. From recent pay runs to updated employee records, you can review every action performed by your payroll staff.

Videos