Welcome to Prospectwiki

Product Overview

Generate company statutory accounts and corporation tax returns, and file them directly with HMRC and Companies House.

Generate personal tax returns and file them directly with HMRC.

Generate sole trader accounts.

Xero Tax for accounts and tax compliance

Take control of accounts and tax returns for companies and individuals all in one place, in the cloud, with Xero Tax.

- Manage tax returns

- Produce corporate and personal tax returns.

- Share data across Xero

- Data flows between books, accounts and tax returns.

Produce accounts easily

- Streamline clients’ accounts production.

- Submit returns online

- File tax returns and accounts from Xero Tax.

Specifications

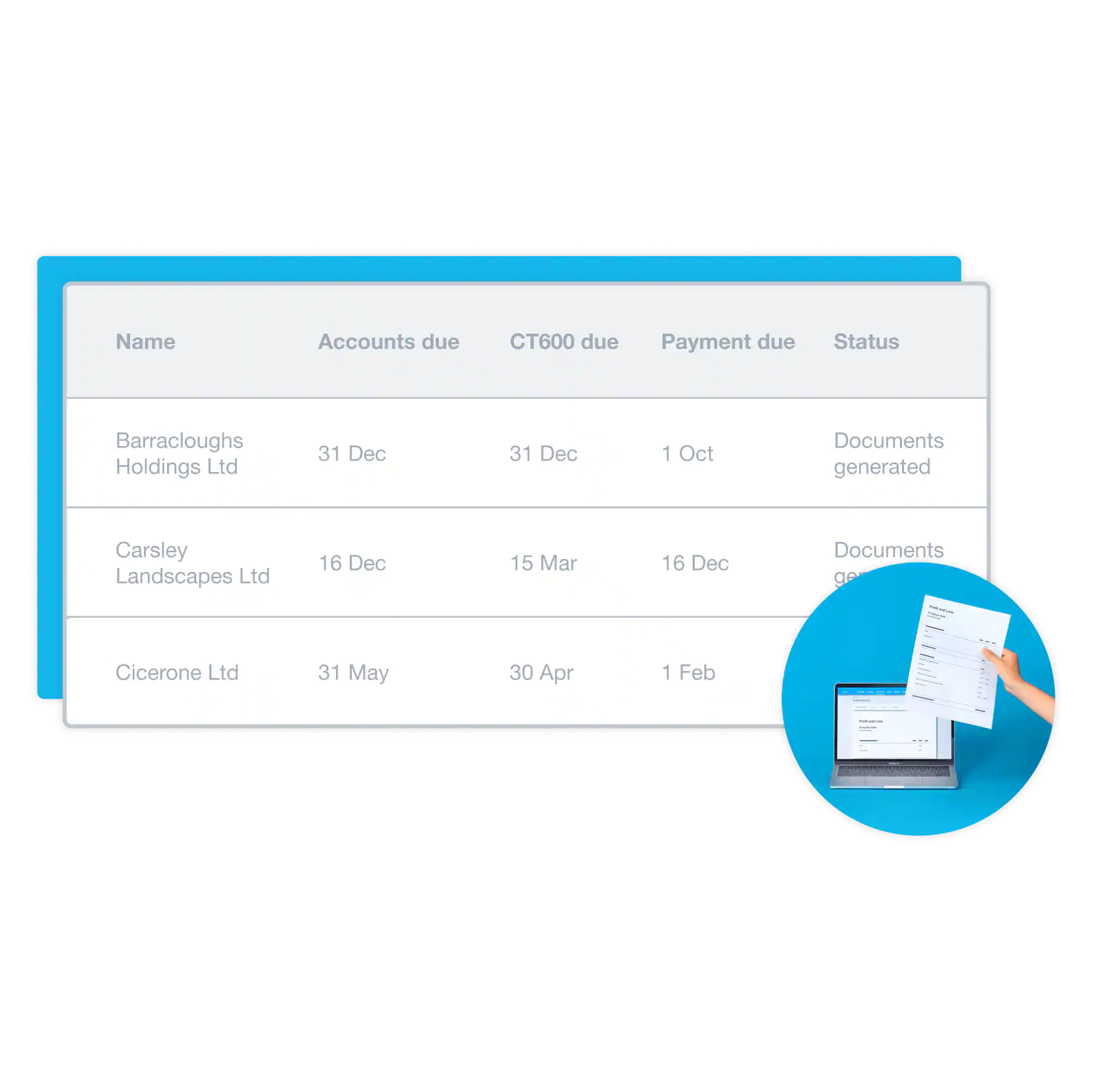

- Manage tax returns

- Xero Tax streamlines compliance by making it much faster to prepare and file accurate accounts and tax.

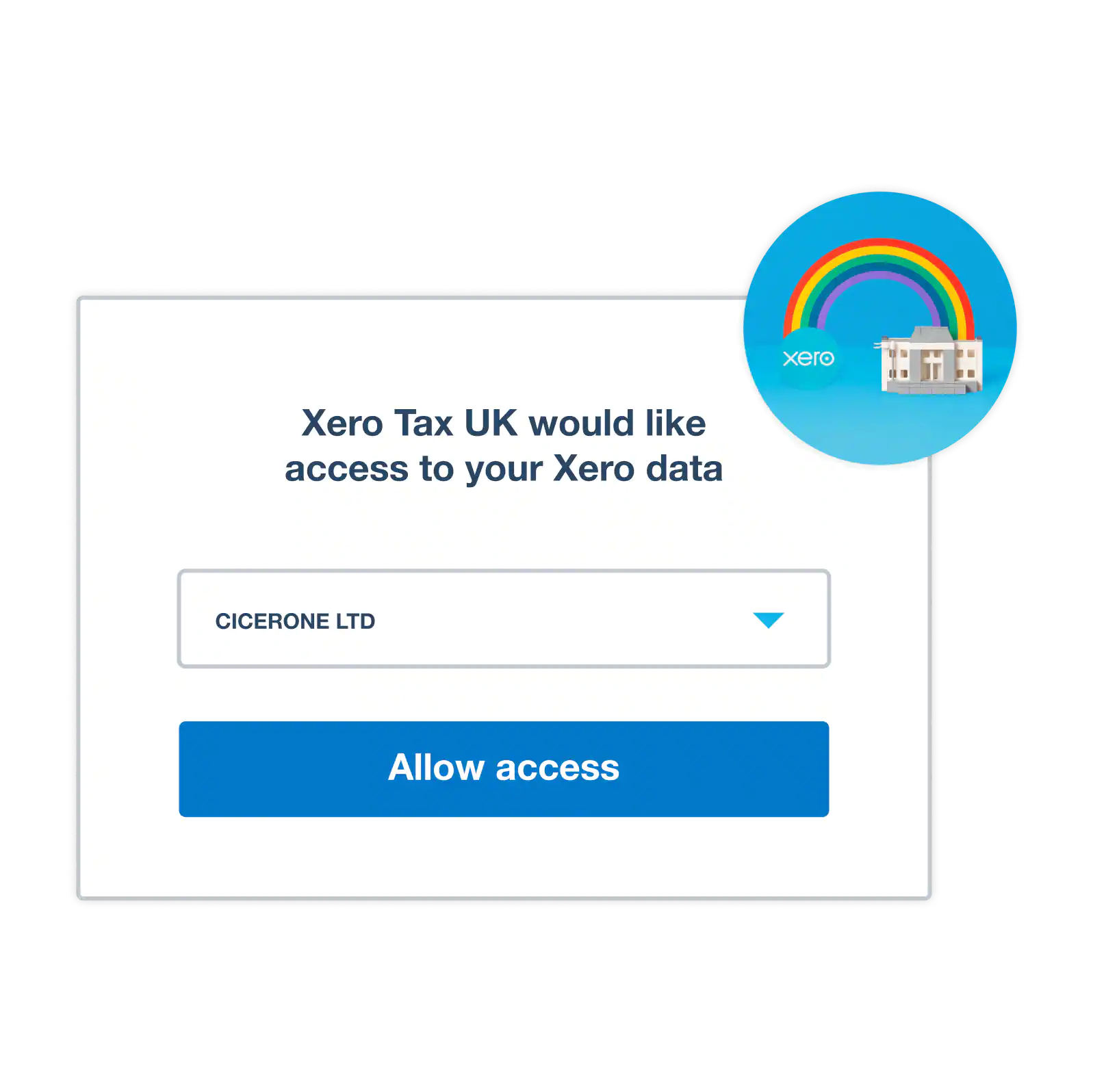

- Connect to bookkeeping data from Xero

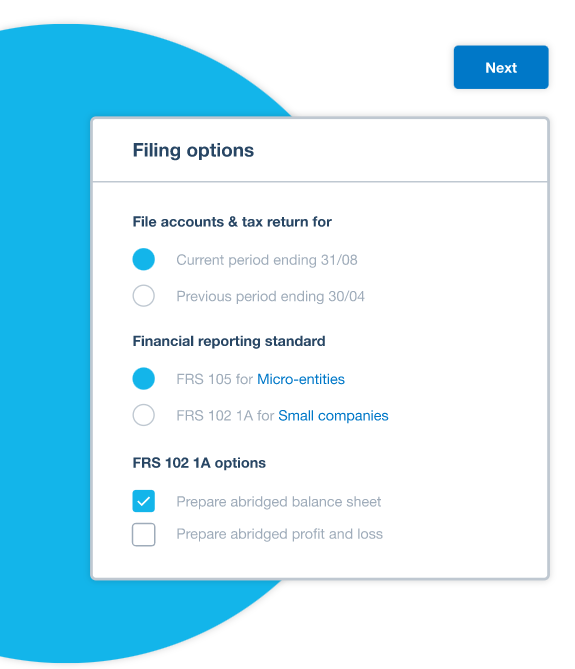

- Produce and file accounts

- Prepare and file company and personal tax returns (SA100 tax return forms, with supplementary pages, some in development, as well as SA302)

- Share data across Xero

- Data flows easily between Xero and Xero Tax which keep data entry to a minimum.

- Data is protected by multiple layers of security

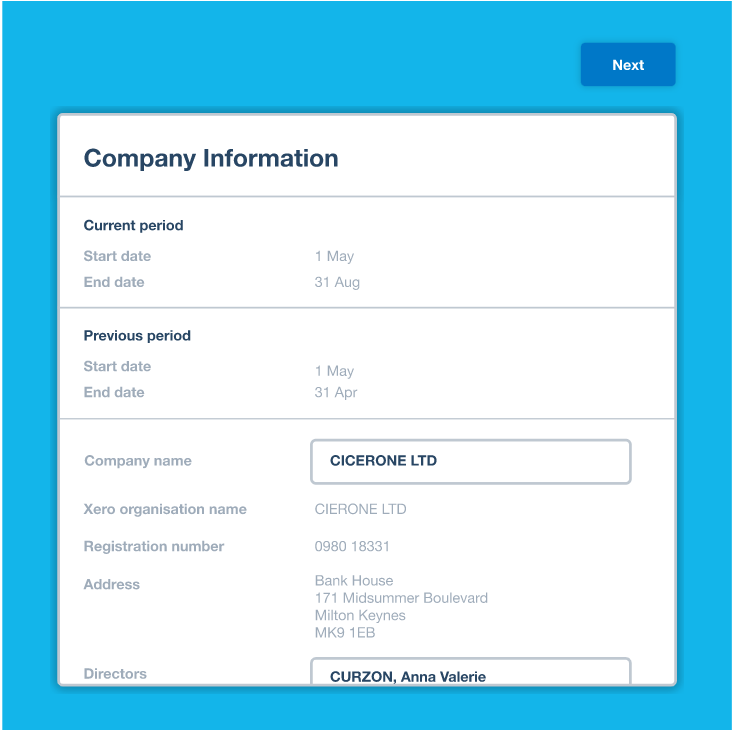

- Client details and accounts data flow from Xero into Xero Tax

- Import trial balance amounts from Xero accounts into tax returns

- Produce accounts easily

- Streamline accounts production for sole traders as well as companies.

- Populate company accounts and tax returns from Xero’s core data

- Retrieve data from Companies House to populate company accounts

- Produce accounts for sole traders, with income schedules populated from Xero

- Submit returns online

- File annual accounts and tax returns for company and individual clients directly from Xero Tax.

- Submit corporate tax returns for company clients to HMRC

- Submit personal tax returns for individual clients to HMRC

- File company accounts with Companies House direct from Xero

Videos

Products You May Also Be Interested In

Products You May Also Be Interested In